Southeast Asia Insurance Industry

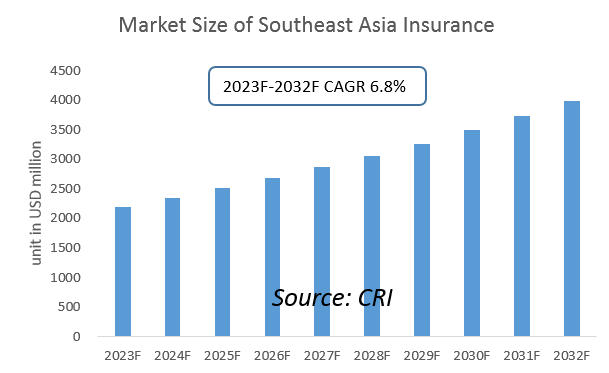

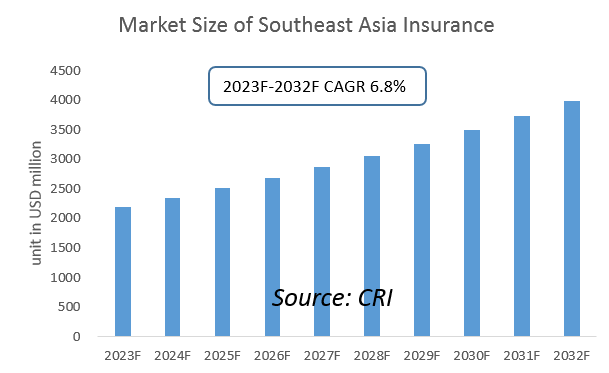

The Southeast Asia insurance industry is poised for growth, with a projected compound annual growth rate (CAGR) of 8.3% from 2023 to 2032.

This growth is being driven by a number of factors, including:

- Increasing disposable income: The growing middle class in Southeast Asia is having more disposable income to spend on insurance products.

- Rising awareness of insurance: There is a growing awareness of the importance of insurance in Southeast Asia, as people become more aware of the risks they face.

- Digitization: The insurance industry in Southeast Asia is undergoing a digital transformation, which is making it easier for people to buy and manage insurance products.

- Expansion into new markets: Insurance companies are expanding into new markets in Southeast Asia, such as Myanmar and Cambodia, which are still underpenetrated.

The Southeast Asia insurance industry is also being affected by a number of challenges, including:

- Lack of infrastructure: Some countries in Southeast Asia have limited infrastructure, which can make it difficult to distribute insurance products and services.

- Regulatory challenges: There are different regulatory regimes in place in different countries in Southeast Asia, which can make it difficult for insurance companies to operate across borders.

- Competition: The insurance industry in Southeast Asia is becoming increasingly competitive, as more companies enter the market.

Despite these challenges, the Southeast Asia insurance industry is still poised for growth. The region has a large and growing population with increasing disposable income, which is creating a large potential market for insurance products. The insurance industry is also benefiting from the digitization of the economy, which is making it easier for people to buy and manage insurance products.

Buy the report Research Report on Southeast Asia Insurance Industry 2023-2032

Key players in the Southeast Asia insurance industry include:

- AIA Group

- Prudential plc

- Allianz SE

- Great Eastern Holdings

- Manulife Financial Corporation

- Tokio Marine Holdings Inc

These companies are all well-established and have a strong presence in Southeast Asia. They are also investing in new technologies and products to meet the needs of the growing market.

The Southeast Asia insurance industry is a dynamic and growing market. It is expected to continue to grow in the coming years, driven by the factors mentioned above. This growth presents opportunities for insurance companies to expand their businesses and reach new customers.

Related: Philippine Electric Vehicle Industry Poised for Growth 2023-2032