Vietnam’s Light Truck Market

In Vietnam’s automobile market, light trucks have emerged as best sellers, driven by their versatility and affordability. These vehicles, including pickup trucks, serve multiple purposes, from daily commuting to weekend family trips and commercial use. The Vietnam light truck industry is experiencing significant growth, with several notable companies, including Ford Ranger, Mazda BT-50, Mitsubishi Triton, Nissan NP300 Navara, Chevrolet Colorado, Isuzu D-Max, and Toyota Hilux, competing in the market alongside Chinese brands like Jiangling Motors.

Manufacturers in Vietnam typically favor the complete knock-down (CKD) import approach for light trucks, where parts are imported and assembled locally. In contrast, fully assembled (CBU) units are preferred for heavy-duty trucks due to favorable import tariffs. This distinction stems from lower CKD tariffs for light trucks and lower CBU tariffs for heavy trucks, influencing import activities with a significant focus on the heavy-duty truck segment.

A notable development in the industry was the threefold increase in registration fees for light trucks and vans in 2019, as mandated by Order No. 20 of April 2019. Light trucks with up to 5 seats now pay 60% of the first registration fee for cars with up to 9 seats, significantly impacting the market dynamics, particularly in Hanoi.

The resilience of Vietnam’s light truck market is evident as TCMV introduces three new models in partnership with SGMW, a joint venture between SAIC, General Motors China, and Liuzhou Wuling Motors, in 2021. Vietnam’s courier, express, and parcel (CEP) services market, valued at US$ 710 million in 2021, is expected to exceed US$ 4.9 billion by 2030, with a significant portion relying on light trucks for transportation.

With the gradual economic recovery in 2022 and improved supply chain conditions, automakers have enhanced their supply to the market. The rise of online shopping in Vietnam has driven demand for new warehouses and logistics services, boosting short-distance delivery. As a result, the demand for light trucks in Vietnam’s market is expected to continue its upward trajectory.

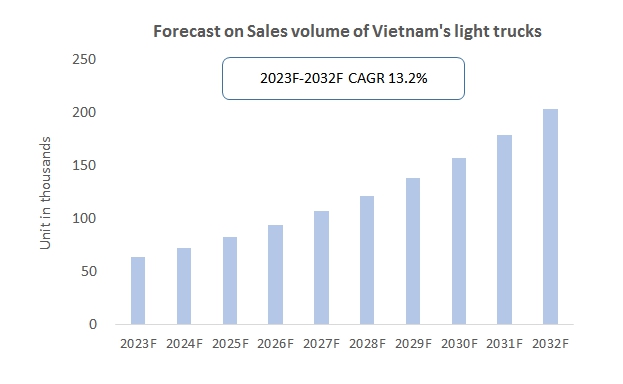

In 2022, Vietnam saw approximately 50,000 light trucks sold. CRI’s forecast anticipates continued growth in the light truck industry, with sales projected to reach 200,300 units by 2032, representing a compound annual growth rate (CAGR) of 13.8% between 2023 and 2032, according to Vietnam Light Truck Industry Research Report 2023-2032

For light truck manufacturers, Vietnam is poised to become one of the world’s highest growth markets over the next decade, offering numerous opportunities for market expansion.

Related: 5 Key Insights from 2023 Thailand Light Truck Industry